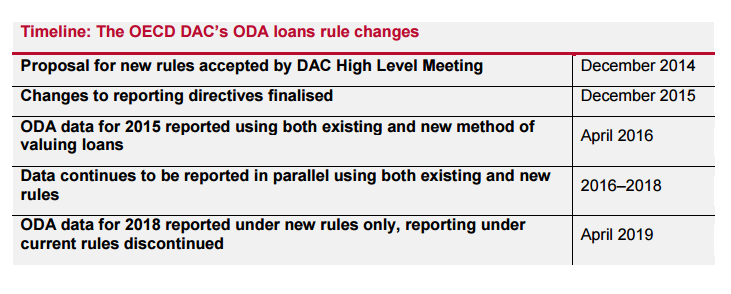

Over recent years, an increasing proportion of official development assistance (ODA) has been given in the form of loans rather than grants. To improve the accounting methods used for deciding what should be counted as concessional loans, the Organisation for Economic Co-operation and Development (OECD)’s Development Assistance Committee (DAC) has agreed to overhaul the method for calculating how much of a donors’ lending should be counted as ODA. When they come fully into force, these rules will mark the biggest change in the way ODA is measured since the concept was introduced in the 1960s.

The amount of ODA provided in the form of loans has been on the increase since the middle of the last decade. This report examines these trends over the period 2005 to 2013, highlighting the main providers and recipients of loans and showing how the balance has changed between loans and grants for these countries. It also looks at the most recent data on ODA loans alongside measures of debt sustainability, in order to address the question of whether ODA loans are being given to countries that can afford to repay them. The new rules on accounting for ODA loans are examined in detail, the changes explained and an assessment made of what the impact on ODA levels might be.

This report summarises some important implications and considerations for policy-makers and stakeholders.

View our summary presentation of key trends, findings and implications explained by the report author Rob Tew. This was originally presented as a free webinar ‘Understanding ODA Loans’ on 24 June 2015.

Key findings

Trends in loan giving

- In aggregate, ODA loans have risen faster than grants and now account for over a quarter of total ODA disbursements to developing countries. Gross ODA lending from DAC donors increased by 73%, whereas ODA grants from DAC donors (excluding debt relief) grew at a much slower pace, rising by just 25%.

- Growth in ODA loans has been driven by a small group of donors. For some of these, the growth in ODA loan giving has far outstripped increases in ODA grant giving. For example, France more than trebled its lending, while French grants fell in real terms.

- The increase in ODA loans seems to be more pronounced in countries receiving higher overall levels of ODA. Some ODA recipients have seen loans increase at a much greater pace than grants, including a number of low-income countries. Four countries – Egypt, Kenya, Myanmar and Turkey – saw an increase in ODA loans of over 500%.

- The most recent data shows that donors typically give ODA in the form of loans to developing countries who are not overburdened with debt. However, overall levels of indebtedness and the cost of servicing that debt looks likely to increase for many developing countries over the next few years.

Impact of the new DAC rules

- Under the new rules, only the grant element of a loan will be reported as ODA rather than the full face value. Also, loan repayments will no longer be subtracted from the headline ODA figure. These new rules certainly give a fairer measure of ODA in the sense that highly concessional loans will count for more ODA than loans at lower levels of concessionality. For loans disbursed under the new rules, it is sensible to discontinue the practice of subtracting loan repayments from the headline ODA figure as only the grant element of the original loan will have been reported in the first place.

- Loans disbursed under the old rules will also no longer have their repayments subtracted from the headline ODA figure. This has a distorting effect, meaning that, for some countries, the reported levels of ODA will appear significantly higher than under the old rules. For example, Japan’s reported 2013 ODA appears over 50% higher when the new rules are applied.

- Another effect of no longer subtracting loan repayments from headline ODA is that, in the long run, development assistance given in the form of loans will generate a higher level of reported ODA than was the case under the old rules. This may incentivise donors to give more aid in the form of loans to maximise their reported levels of ODA.

- The new rules allow donors to report a higher level of ODA for a loan to a low income country than for the same loan to a middle income country; this could create an incentive for donors to give more loans to the poorest countries.

- Some important elements of the new rules, especially in the area of debt relief, have yet to be agreed.

Recommendations

- It is vitally important that donors pay close attention to debt sustainability when making lending decisions in the future. This is especially true in light of the increasing debt burden likely to be faced by many developing countries and the potential for the new ODA loan rules to incentivise lending to low income and least developed countries.

- The OECD should look again at the decision to no longer subtract loan repayments on old ODA loans from the headline ODA figure under the new measure. This decision will have a distorting effect on the ODA totals for years to come.

- Reforms to the measurement of ODA loans should be accompanied by similar reforms in the measurement of the value of debt relief in the ODA statistics. In the past the measurement debt relief has significantly overstated the amount of ODA disbursed by donors.

- The proposed cash flow measure of ODA which will be reported alongside the new headline statistics should include loan interest repayments in its cash flow considerations and not just loan capital repayments as in the present measure of ‘net ODA’.