The role of the private sector: financing a post-2015 agenda for sustainable development

Private finance flowing into developing countries is growing fast. However, there are challenges to establishing effective mechanisms to unleash its development potential. And unless public-private partnerships for development work to maintain the hard won principles of development aid, like transparency and accountability, the potentially positive impacts of private investments in sustainable development could be undermined.

These are the findings of a major new report launched by the European Parliament this week, focusing on the role of multilateral institutions, development finance institutions (DFIs) and aid agencies in building public-private partnerships for development and examining the various policy options and mechanisms that are now being explored, in the context of post-2015 financing debates. *

Below are some top line findings and messages from the report that especially resonated with us:

Private finance is growing…bringing new opportunities for developing countries

In recent years we have seen a sea change in the general approach to the role of private finance in development circles. Recognition of the growth of private finance, such as foreign direct investment (FDI) has led many actors to expand blended mechanisms of financing and experiment with new models that look to unleash the development potential of these resources. As we move towards the establishment of an ambitious post-2015 agenda, this is important: realising the end of poverty will require partnerships and the alignment of actors from all sectors.

The numbers on FDI underscore the necessity of considering the contribution of the private sector in any discussion about how to finance global development goals. Total investment in developing countries grew from 24% of GDP in 2000 to 32% in 2011. Private finance now accounts for the largest international flows to developing countries: FDI totalled US$472 billion in 2011, and loan disbursements almost US$700 billion. These are enormous numbers, especially in comparison to the amount of official development assistance (ODA) available.

There are challenges to unleashing the potential of private finance for development

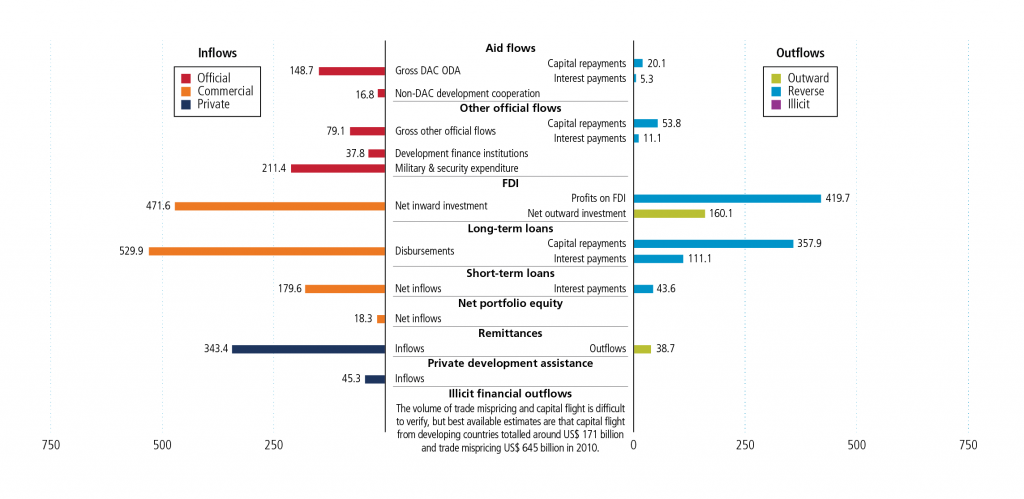

There are two issues with the top-line FDI figures, once you look deeper. First, outflows of private finance from many developing countries are also extremely large. Often, they aren’t productive investments in other countries but loan repayments, repatriated profits or illicit finance. FDI is an important example: the repatriated profits on FDI leaving developing countries were equivalent to almost 90% of new FDI in 2011.

Second, some FDI ‘inflows’ are actually the reinvestment of profits earned within the country: i.e. not an inflow. This may be significant: reinvested earnings accounted for over 60% of ‘outward’ FDI from developed countries in 2012. The infographic below demonstrates (click to enlarge).

A fluid mix of resources flows into and out of developing countries. Amounts in US$ billions, 2011

Additionally, efforts to incentivise and mobilise private finance and channel it towards sustainable development objectives in practice have faced a number of challenges. For example, while most jobs in developing countries are created by MSMEs (micro, small and medium enterprises), the report finds that DFIs have struggled to design programmes that work for small enterprises on a large scale. There are important questions about what the involvement of public resources adds to private investments: development-effective mechanisms should stimulate investments that would not otherwise have been made (financial additionality), or influence the business model to follow a more development-friendly approach (operational additionality). Yet evidence as to whether this is actually happening is weak. Ownership over DFIs and their blended mechanisms by developing countries has also been found to be low.

There is a tension between business confidentiality and adhering to the fundamental development principles (and commitments) of transparency and accountability. Standard practice for many institutions working with the private sector is to withhold information deemed commercially sensitive including, for example, impact evaluations. Many investments are made through financial intermediaries and little information is made available of how funds are spent through the chain.

Transparency and accountability are essential in public-private partnerships for development

It is vital that institutions which have committed to be transparent and accountable retain these values in partnerships with private finance. Transparency underpins a continued focus on development outcomes and pushes institutions to prove the impact of the models they are experimenting with. Ultimately, as we move towards a post-2015 agenda that will require partnerships between all actors, public and private, it helps us learn which models work best.

Both public and private resources will have a vital role to play in realising the post-2015 vision. It is important that we recognise the roles of different types of finance, their different strengths and what each type of finance can best contribute to financing development and the end of poverty. Only through fully understanding these challenges, and working transparently, can we find mechanisms that can be truly transformative.

*Full disclosure – I was one of the co-authors of the report, along with Javier Pereira and Jesse Griffiths at Eurodad and Matthew Martin at DFI.

Full report: European Parliament: Financing for Development in Post-2015. You can also read Jesse’s blog at the Eurodad site here.

Related content

Priorities for the UK’s incoming Secretary of State Alok Sharma

As Alok Sharma takes office as Secretary of State, DI's Amy Dodd sets out key priorities for the UK and its global development agenda.

From review to delivery on the Global Goals – what should the immediate priorities be for the UK government?

On 26 June, the UK government published its Voluntary National Review measuring delivery against the Global Goals - but does it accurately capture progress?

Three priorities for the High-level Political Forum 2019

DI Director of Partnerships & Engagement Carolyn Culey sets out three key priorities for closing the gap between the poorest and the rest at HLPF 2019